Forms new consortium with same investors, and jointly with Alibaba Singapore, redevelop AXA Tower

(Singapore, 6 May 2020)

Perennial Real Estate Holdings Limited (“Perennial”) has through Perennial Shenton Investors Pte. Ltd. (“PSIPL”), a Perennial-led entity comprising a consortium of investors, entered into a share purchase agreement (“SPA”) with a subsidiary (“Alibaba Singapore”) of Alibaba Group Holding Limited(“Alibaba”), a company listed on the New York Stock Exchange and the Hong Kong Exchanges and Clearing Limited, for the sale of a 50% stake (the“Sale Shares”) in Perennial Shenton Holding Pte. Ltd. (“PSHPL”) and the transfer of 50% of the shareholders’ loan outstanding (the “Loan”) to Alibaba Singapore based on an agreed property price of S$1.68 billion (the “Agreed Property Price”) (the “Sale”).

PSHPL indirectly owns AXA Tower, a 50-storey landmark Grade ‘A’ office development with a retail podium sited within Singapore’s Central Business District (“AXA Tower”). Perennial currently indirectly owns an effective 31.2% stake in AXA Tower.

Concurrently, Perennial has together with the same consortium of investors formed a new entity, PRE 13 Pte. Ltd. (“Perennial Newco”), and through PSIPL, transferred the remaining 50% equity stake (the “Balance Shares”) in PSHPL and 50% of the Loan Outstanding (the“Share Transfer”) to Perennial Newco. Perennial will indirectly own a 20% stake in Perennial Newco and an effective 10% stake in AXA Tower.

Upon completion of the Sale and the Share Transfer (together, the “Transaction”), which is expected to take place around June 2020, subject to the conditions precedent being satisfied, Perennial Newco and Alibaba Singapore will enter into a joint venture agreement for the redevelopment of AXA Tower.

Perennial’s share of the net proceeds following the Transaction is expected to be approximately S$196.4millionand its share of the divestment gain is approximately S$45million. The balance proceeds, after Perennial’s reinvestment into Perennial Newco, is expected to be approximately S$137.6 million.

AXA Tower currently has an existing gross floor area (“GFA”) of approximately 1.05 million square feet (“sq ft”). Based on Urban Redevelopment Authority’s Master Plan 2019, AXA Tower has already secured an approved uplift in its gross plot ratio which would increase the development’s existing GFA from approximately 1.05 million sq ft to approximately 1.24 million sq ft. Approval has also been obtained to further increase AXA Tower’s GFA to 1.55 million sq ft should it integrate hotel and residential usage under the CBD Incentive Scheme.

Mr Pua Seck Guan, Chief Executive Officer of Perennial, said, “The divestment of AXA Tower aligns with our capital recycling strategy to deliver a divestment gain, while retaining our involvement to create value via the redevelopment of the prime property which is strategically sited within the Greater Southern Waterfront with breathtaking sea views. Alibaba is already an anchor tenant at AXA Tower, and we are pleased to have their support in creating an iconic landmark in Singapore’s CBD.”

Brief Details on the Transaction

The consideration for the Sale Shares is based on the net asset value (“NAV”) of PSHPL as at closing, calculated based on the Agreed Property Price, and subject to certain adjustments for the NAV of PSHPL as at closing. The consideration for the Sale Shares was determined after arm’s length negotiations between PSIPL and Alibaba Singapore, taking into consideration the current market value of AXA Tower. The consideration for the Loan will be 50% of the principal outstanding under the Loan as at closing.

Within the prescribed period after the execution of the SPA, a deposit of S$16 million will be paid into an escrow account which will be retained by PSIPL on closing. The balance consideration for the Sale Shares and the Loan will be paid in cash, once such computation has been derived based on the agreed terms in the SPA. The completion of the Sale is subject to the satisfaction or waiver of the condition that Perennial Shenton Property Pte. Ltd. secure financing for a principalamount of not less than 65% of the Agreed Property Price and other customary conditions precedent.

The consideration for the Balance Shares is based on the NAV of PSHPL as at closing, calculated based on the Agreed Property Price, and subject to certain adjustments for the NAV of PSHPL as at closing. The consideration for the Balance Shares was determined after arm’s length negotiations between PSIPL and Perennial Newco taking into consideration the Agreed Property Price. The consideration for the Loan will be 50% of the principal outstanding under the Loan as at closing.

The proceeds received by PSIPL from the Sale and the Balance Shares will be upstreamedproportionately to Perennial and the consortium members in accordance with their shareholding in PSIPL. Perennial will then utilise a portion of such proceeds to reinvest in the Perennial Newco.

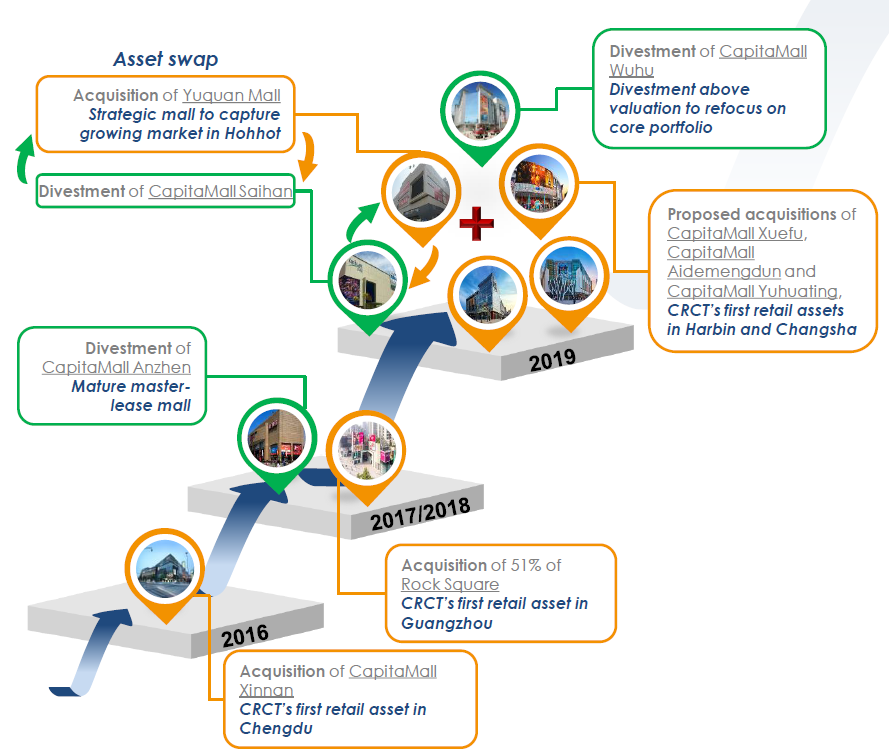

CapitaLand Retail China Trust Management Limited (CRCTML), the manager of CapitaLand Retail China Trust (CRCT), today announced that CRCT has entered into an agreement with a subsidiary and associated companies of CapitaLand Limited to acquire 100% interests in three companies that hold three malls in China –CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin and CapitaMall Yuhuating in Changsha. The accretive acquisition will diversify CRCT’s footprint in China from eight cities to 10 and enable it to gain exposure to two rising provincial capital cities with strong economic fundamentals and long-term growth potential, namely Harbin in Heilongjiang Province, north China and Changsha in Hunan Province, central China.

CapitaLand Retail China Trust Management Limited (CRCTML), the manager of CapitaLand Retail China Trust (CRCT), today announced that CRCT has entered into an agreement with a subsidiary and associated companies of CapitaLand Limited to acquire 100% interests in three companies that hold three malls in China –CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin and CapitaMall Yuhuating in Changsha. The accretive acquisition will diversify CRCT’s footprint in China from eight cities to 10 and enable it to gain exposure to two rising provincial capital cities with strong economic fundamentals and long-term growth potential, namely Harbin in Heilongjiang Province, north China and Changsha in Hunan Province, central China.